Text from the announcement released by Q Ltd on Friday, August 29, 2014

Text from the announcement released by Q Ltd on Friday, August 29, 2014

1. Acquisition of Crowd Mobile.com

Q Limited has entered into a binding term sheet to acquire 100% of the shares in a number of companies making up the Crowd Mobile group (Crowd Mobile).

Highlights:

- Crowd Mobile is global mobile entertainment and micro job company.

- In FY2014, Crowd Mobile derived $9.7m in revenue and $2.2m in EBITDA (unaudited management accounts).

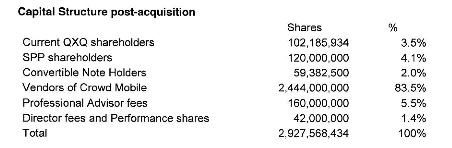

- The purchase consideration is $12,220,000, satisfied by the issue by Q of 2,444,000,000 fully paid ordinary shares at 0.5 cents each. The consideration represents a purchase price of approximately 5.6x FY14 EBITDA.

- The share capital of Q will be consolidated on a ratio of 40:1 (subject to approval).

About Crowd Mobile

Crowd Mobile is a global mobile entertainment and micro job business that operates

in Australia, NZ, UK, Ireland, Germany, Netherlands & Switzerland. It provides its services across SMS and Apps to a significant customer base that included over 3.4 million paid questions over FY14. The Crowd Mobile website is located at www.CrowdMobile corn

Crowd Mobile operates the "sms & App" market, providing services to users through their mobile phone and tablet devices. It has a number of brands and an experienced management team.

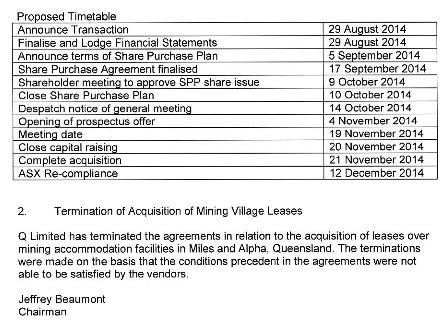

The all-scrip offer for Crowd Mobile is subject to shareholder approval and certain conditions precedent. The acquisition is expected to be completed by December 2014. Q intends to raise funds to undertake the transaction via a Share Purchase Plan (SPP) to raise up to $600,000.

The acquisition will constitute a change in the nature and/or scale of the activities of Q in accordance with Chapter 11 of the ASX Listing Rules. This will require Q to re-comply with the ASX admission requirements of Chapters 1 & 2 of the ASX Listing Rules. The admission requirements will, amongst other things, require Q to issue a prospectus. Q intends to raise up to $1m under that prospectus.

A summary of the key terms of the acquisition is provided below. Further details of the transaction and consideration will be set out in the Notice of Meeting to be sent to shareholders to consider and approve the acquisition at a meeting to be held at the earliest opportunity.

Summary of Acquisition Terms:

The terms of the acquisition are as follows:

- On the receipt of all relevant approvals, Q will acquire all of the issued capital of Crowd Mobile.

- The consideration for the acquisition is the issue to the vendors of 2,444,000,000 ordinary fully paid shares, each issued at an issue price of $0.005 (on a pre-consolidation basis) (Consideration Securities).

- The shares in Q, including the Consideration Shares, are to be consolidated on a ratio of 40:1

- Q will issue performance share rights to the management of Crowd Mobile.

The performance share rights will be issued in four tranches which will automatically convert to ordinary shares on the satisfaction of the following milestones:

(i)130,000,000 (pre-consolidation) Class A Performance Shares — the Purchaser achieving EBITDA of $4,000,000 on an annualised basis within any consecutive 6 month period within 4 years of completion of the Acquisition;

(ii) 130,000,000 (pre-consolidation) Class B Performance Shares — the Purchaser achieving revenue of $15,000,000 on an annualised basis within any consecutive 6 month period within 4 years of completion of the Acquisition;

(ill) 130,000,000 (pre-consolidation) Class C Performance Shares — on the Purchaser achieving App downloads of 500,000 within 4 years of completion of the Acquisition; and

(iv) 130,000,000 (pre-consolidation) Class D Performance Shares — on the Purchaser rolling out 50 Apps within 4 years of completion of the Acquisition.

- The current directors will be paid outstanding directors fees by way of a combination of an allocation shares at .5c (on a pre-consolidation basis) and cash

Completion of the Acquisition is conditional upon the satisfaction of the following conditions precedent:

(a) the Purchaser completing commercial, financial, technical and legal due diligence on the members of the Crowd Mobile Group and their assets, undertakings and business operations, to the sole and absolute satisfaction of the Purchaser (acting reasonably);

(b) the Sellers completing a commercial, financial, technical, and legal due diligence on the Purchaser, to the sole and absolute satisfaction of Sellers (acting reasonably);

(c) the Purchaser, having obtained all necessary shareholder approvals (including shareholder approvals: under Chapter 11 of the Listing Rules; for a share consolidation on a 40:1 basis; and under Section 611 item 7 of the Corporations Act in respect of any party who may go above 20% as a result of the transactions contemplated in this Term Sheet), required by the Corporations Act and the Listing Rules in relation to the Acquisition;

(d) the parties obtaining any necessary regulatory approvals on terms acceptable to the parties as are required to give effect to the Acquisition, including (if required) re-compliance with chapters 1 and 2 of the listing rules of ASX on terms required by ASX; and

(e) the Purchaser completing a capital raising of not less than 81,000,000 at a price per share of 80.20 (post consolidation).

Following completion, the Board of Q will be as follows:

(a) 3 directors nominated by Crowd Mobile; and

(b) 1 existing director of Q.

Domenic Carosa is available for interviews on 0411 19 69 79. Please call John Harris on 0414 789 995 or email john@impress.com.au if you require a publication-quality photo or any other assistance.

Related News

- Deloitte names Centrify on North American Fast 500 Centrify overnight revealed its inclusion on Deloitte’s Technology Fast 500™, a ranking of the 500 fastest growing technology, media, telecommunications, life sciences and clean te...

- New $7 million flying intensive care unit ‘lands’ in SA Today’s dedication of a new ‘flying intensive care unit’ by the Royal Flying Doctor Service (RFDS) marks the start of a five-year wave of investment by the RFDS i...

- iiNet to deliver cloud services for SA Govt iiNet today announces that it will deliver the benefits of cloud computing, including on-demand deployment and consumption-based pricing, to the SA Government. The revolutionary c...

- Senior Centrify exec visits Australia to meet customers David McNeely, a senior Centrify executive who has worked in the identity management space for the past 20 years, is visiting Australia this week to speak today at Gartner's ...